Oro Valley wants you to “Know Your Town’s Budget”

Published on June 23, 2021

Oro Valley, Arizona (June 23, 2021) – At its June 16, 2021 meeting, the Oro Valley Town Council approved the adoption of the final budget for fiscal year 2021/22, in the amount of $162 million; a $56.5 million, or 53% increase from the Adopted FY 2020/21 Budget of $105.4 million.

“The Town of Oro Valley continues to be in a very strong financial position,” said Town Manager Mary Jacobs. “With clear priorities from the Town Council, the FY21/22 adopted budget includes resources that will enable the Town to finance $25 million in parks and recreation capital projects, resolve its unfunded police pension liability and continue to provide the high level of services to the community that our residents have come to enjoy.”

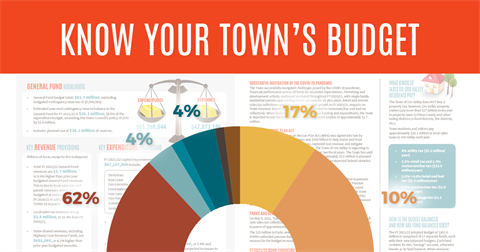

The Town of Oro Valley understands that not everyone has the time nor desire to peruse a lengthy, technical budget document. To make the budget more accessible, the Town publishes a simple, two-page summary each year entitled, “Know Your Town’s Budget.” A quick review of this document will provide residents with an overview of the Town’s key revenues and expenditures, as well as a closer look at the services provided, such as public safety, roads and road maintenance, and parks and recreation.

Click here to view or download the FY 2021/22 Know Your Town’s Budget.

S&P affirms Oro Valley’s AA+ rating; PSPRS bond issuance at 2.39%

S&P Global Ratings has affirmed its AA+ rating for the Town of Oro Valley’s upcoming $18 million in pension obligation bonds (Public Safety Personnel Retirement System, or PSPRS). Among other things, S&P noted that the Town of Oro Valley has strong economic fundamentals, extraordinarily strong maximum annual debt service coverage, and low volatility of its sales tax collections. This rating helped the Town obtain a highly competitive interest rate of 2.39% for the bonds, which ultimately lowers the amount the Town pays for its chosen method of reducing its PSPRS unfunded liability. Bonds are projected to be issued July 1, 2021, and will be combined with $10 million in reserves, resulting in 100% funding for its public safety pension systems.